Official: Pay To Chain is Dead

Entrepreneurship is a lonely journey. No one wants to talk about a failed startup. Not even my wife and daughter. I can only talk about the post-mortem to myself on my blog.

I failed publicly. But not the type of failure you would read on the top news in the business section. It's not a company finding initial success then going into certain chaotic situation which bankrupt itself. Instead, I've been blasting over my entire network about my startup for years but made no traction at all. I'd met and communicated with a long list of people because of this. VC, angel investors, potential customers, technologists, domain expert, government officials, etc. Failure simply means everyone in my network knows I've been working on a business idea that doesn't work.

How it Started

ChainTech.show is a podcast of the Global Supply Chain Council. I used to work for a couple of great startups. One in the logistics and another one in the supply chain. I had a light bulb moment. I want to facilitate the money flow for the global supply chain.

In 2021, numerous CBDC initiatives sprung up all over the world, carrying out by central banks. There's even an open-source database to provide information and compare these initiatives called CBDC Tracker. CBDC is built on blockchain and have most the advantages of cryptocurrency has. Namely, immutable, decentralized, secured, etc. For years I had conversations with supply chain executives; the majority of them don't care about the crypto market though. They just want to focus on their core businesses. They're not interested in crypto because of the volatile price. It makes total sense to a factory owner from China to stick with the fiat system to transact with the counterparts from India, as the fiat currency is comparatively stable in price. They're seeking the profit margin in the products they manufacture, instead of the capital gain from the currencies they own. They know the crypto space is lucrative. They just don't have the temptation for it. They wouldn't deviate from their own businesses and go after speculative investment. They're true entrepreneurs, after all.

CBDC is on the blockchain, but it's not a crypto. The price of CBDC will be stable is a safe bet. Plus the security, immutability, convenience, speed, and last but not least the cheaper transaction fee it can provide, an ecommerce owner would be happy to pay his supplier and dropshipper with CBDC.

Pay to Chain is a payment platform the supply chain organization can use to transact with other enterprises in the global supply chain with all the said benefits. It doesn't hold custody of any CBDC. Bypassing the traditional financial infrastructure, it will only circulate them and eliminate all the financial intermediaries. That's how Pay to Chain can provide massive value with a cheap transaction fee.

I hence dived deeper into the supply chain industry, having casual convos and informational interviews with people on a constant basis. On the side, I wrote a white paper Cashless Product Management to CrossBorder Payment. Partially for sharing the knowledge in the FinTech space. But mainly for educating myself and the supply chain professionals at the same time. While my feet sunk deep into the soil of global supply chain, I buried my head in the technical documentations and studied the feasibility of building out such a platform. Aside from the technical details the government officials still had not yet released, my research outcome showed that a combination of blockchain database with the Go and JavaScript programming languages would be the ideal tech stack to realize the vision. It can generate throughput for trillions of concurrent transactions and seamless user experience. Hence, The Complete Guide to Hyperledger Fabric has been written.

Along the Way

I had participated in many business competitions for the purpose of seeking seed funding and increasing exposure to potential customers. It's one of them: Hong Kong Science and Technology Park Elevator Pitch Competition.

You can even see my presence at Wiki Finance Expo Hong Kong. Pay To Chain is one of the FinTech and Payment partners of this event, which is one of the largest and most influential FinTech and Web3.0 events in Asia.

At the Philippine Startup Week, I gave speech about the value propositions. My session is titled: Start Small with the Global Supply Chain in Mind.

At the Hong Kong FinTech Week. I shifted gear to learn from other financial professionals, seeing first-hand how the International Financial Center houses hundreds of other FinTechs alongside Pay To Chain in the City.

When I was honored to run a roadshow at the Proactive Think Tank 明匯智庫, I shifted gear back to talk about supply chain. Educating the audiences how the architectural and product design supports the value propositions. The audiences are seasoned entrepreneurs, such as venture capitalists and public-listing company chairmen. The title of my session: The Supply Chain Enterprise Payment Platform.

Striving for a technological innovation in the intersection of supply chain and financial space, I swam back to the financial sector again, entering the Asia's Premier FinTech Show Money20/20 World Tour.

Alas, after all the work, there's only a cricket in the global supply chain looking at me and saying, "you're a lone nut," Pay To Chain is not in need, "embarrassing yourself with your stupid startup idea."

I didn't find the product market fit.

The Cause of Death

"It's not that easy, my friend." I was having lunch with an angel investor.

"The technical part is easy, the difficult parts are establishing partnerships and navigating the regulation environment." I was consulting a FinTech CTO.

"How do you overcome the jurisdiction issues?" I forgot who asked me this question.

In fact, I cannot pinpoint the root cause. I still believe wholesale CBDC is inevitable; Someone somewhere in the future will put together a payment platform to serve only supply chain stakeholders eventually. It's just not me.

A small piece of history had already proven that the platform is in the making. The central bank of Hong Kong commenced its CBDC journey with Project LionRock in 2017, it was named after Hong Kong’s most iconic mountain. This was a PoC project that studied potential applications of CBDCs in handling large-value payments and delivery-versus-payment settlements.

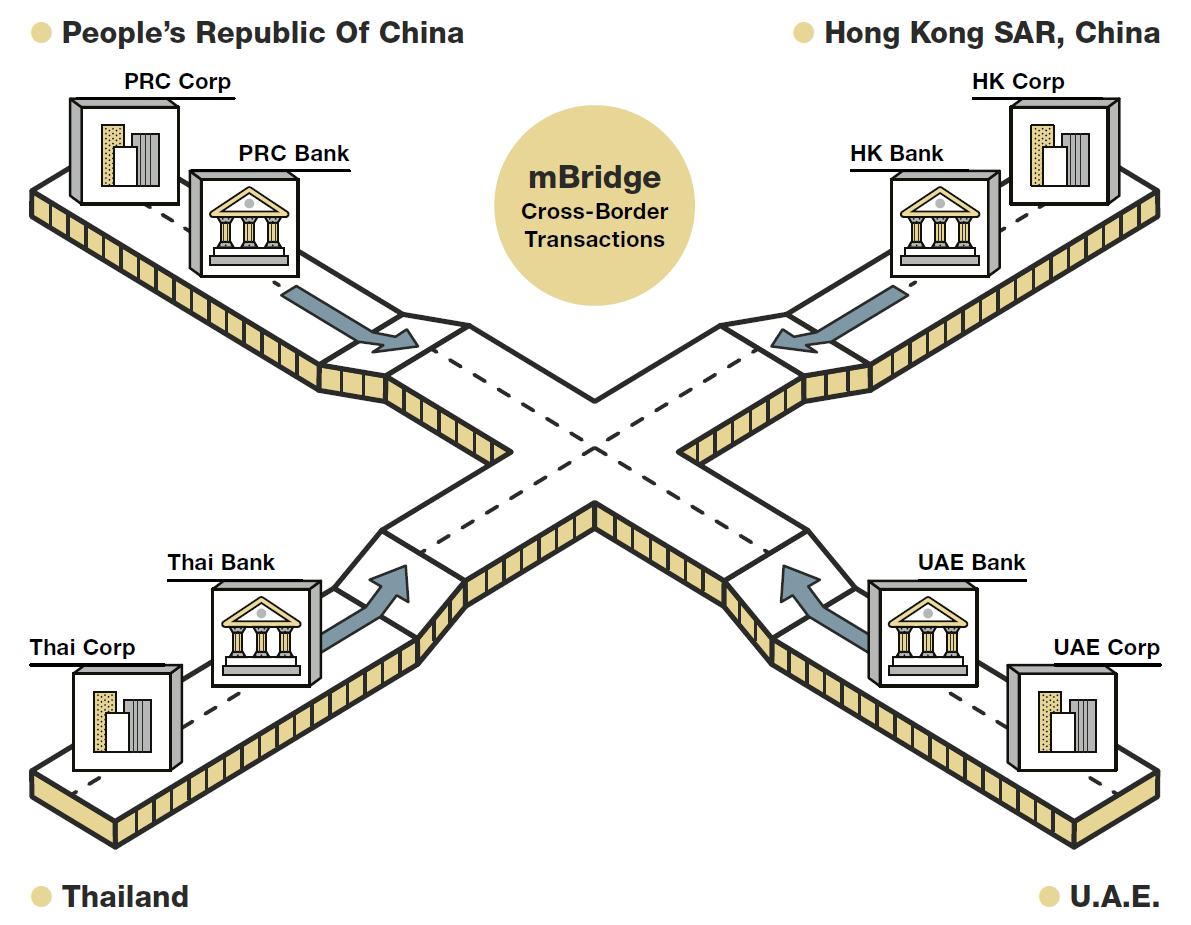

In 2021, I spun up Pay to Chain LLC. In the same year, Bank for International Settlements published a brochure to present the development progress of Project mBridge, the trial platform to facilitate real-time cross-border foreign exchange payment-versus-payment transactions in a multi-jurisdictional context and on a 24/7 basis.

In 2023, after two years immersing in the blockchain space. I had hands-on experience of how to build a financial platform with Red Date's product Blockchain-based Service Network (BSN). I had devoured their 40-page white paper Universal Digital Payment Network (UDPN) I had the sandbox and development environment set up. It never made to the production though. It just didn't have to. I was just tinkering with the technology. Being technological ready when the inevitable comes.

Reaching the end of 2024, I repositioned the company as a web3 studio, changed the company's nature, and renamed it. In the next month, I took a Machine Learning bootcamp. Pay To Chain was gone. Chainsaw Moment came alive, becoming my sandbox to tinker with cutting-edge technology. Since I hadn't landed any clients for Pay To Chain.

The technical infrastructure is ready because of Red Date. The regulatory environment is ready because of the combined effort of the financial institutions. However, the market is not yet ready.

I couldn't find the product market fit.